What do Credit Card Decline Codes Mean? How to Read and What to do with Decline Codes

If you’ve ever had a customer’s card transaction decline, you know how frustrating it can be—for both you and them. Whether you’re running an online store or an in-person business, declined transactions can slow down sales and leave customers confused. The key to handling these situations smoothly is understanding what credit card decline codes mean and how to address them efficiently.

What Are Credit Card Decline Codes?

Credit card decline codes are responses from the card issuer indicating why a transaction was unsuccessful. When a transaction is declined, the payment processor provides a numerical code that corresponds to a specific reason. These codes help businesses and customers understand what went wrong so they can take appropriate action.

Declines can happen for various reasons—insufficient funds, suspected fraud, or technical issues with the card issuer. Some decline codes require simple fixes, like retrying the transaction, while others indicate more serious problems that need further investigation.

Let’s break down these decline codes in a clear and helpful way for Bankcard International Group merchants. We’ll cover what each code means and the best course of action to take.

General Guidance: When you receive a decline code, it’s essential to remain professional and helpful with your customer. Avoid making assumptions about why their card was declined. Your best approach is usually to suggest they contact their issuing bank for more information, or to offer an alternative payment method.

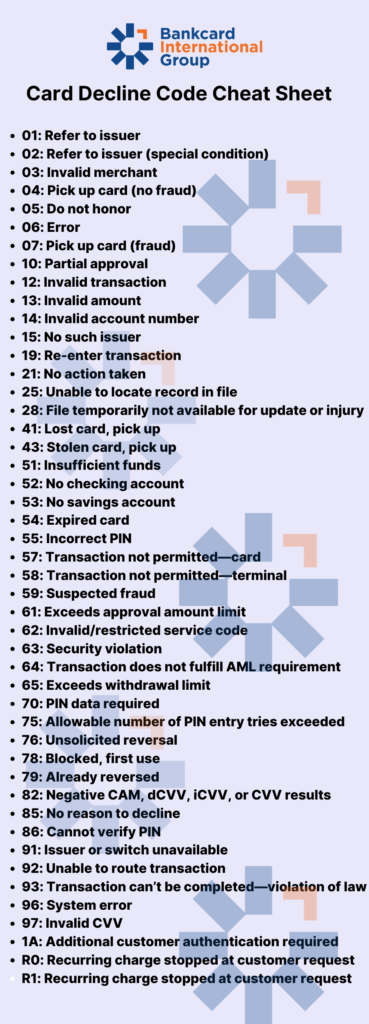

The Most Common Credit Card Decline Code Definitions and Solutions:

- Code 01 & 02: Refer to Issuer: These codes mean the card issuer declined the transaction, but they don’t tell us why. Code 02 sometimes suggests a more serious issue, like a blocked account. In either case, politely ask the customer to contact their bank to resolve the issue. Offer an alternative payment option.

- Code 04: Pick Up Card: This card is no longer valid (expired, cancelled, etc.). If possible, retain the card and inform the customer that their bank has flagged it as invalid. Request another form of payment. Important Note: While this code doesn’t necessarily indicate fraud, exercise caution.

- Code 05: Do Not Honor: This code strongly suggests suspected fraud. Contact the issuing bank immediately for instructions. Be very cautious about accepting another payment method from this customer.

- Code 07: Pick Up Card, Special Condition (Fraud Account): This confirms a fraudulent account. Do not attempt the transaction again. If possible, retain the card and return it to the issuer. Avoid accepting other payment methods from this customer. If you have an existing relationship with the customer (e.g., a recurring subscription), you might suggest they contact their bank, but proceed with caution.

- Code 12: Invalid Transaction: Something is wrong with the transaction details (incorrect card number, CVV, expiration date, etc.). Double-check the information entered. If the problem persists, ask for an alternative payment method.

- Code 13: Invalid Amount: The transaction amount is incorrect (e.g., negative number, special characters). Verify the amount and try again. If the issue continues, contact your payment processor.

- Code 14: Invalid Card Number: The card number is incorrect. Verify the number with the customer’s card. If the number is correct, request another payment method.

- Code 15: No Such Issuer: The card issuer can’t be identified. This could be due to an incorrect card number, a non-existent issuer, or the issuer not being part of your network. Double-check the card number. If the problem persists, the customer will need to use a different card.

- Code 19: Re-enter: A temporary error occurred. Try the transaction again. If the problem continues, contact your payment processor.

- Code 28: File Temporarily Unavailable: The issuer’s system is having trouble accessing the cardholder’s information. Ask the customer to contact their bank. If the problem persists, request an alternative payment method.

- Code 41: Lost Card, Pick Up: The card has been reported lost. Retain the card if possible and return it to the issuer. Be cautious about accepting another payment from this customer.

- Code 43: Stolen Card, Pick Up: The card has been reported stolen. Retain the card if possible and return it to the issuer. Do not accept another payment from this customer.

- Code 51: Insufficient Funds: The cardholder doesn’t have enough money in their account. Inform the customer. They can try again after depositing funds, or use another payment method.

- Code 54: Expired Card: The card is expired. Request an alternative payment method.

- Code 58: Transaction Not Permitted to Cardholder: The card isn’t valid for this type of transaction. This might be due to card type restrictions or technical issues. Request another payment method.

- Code 61: Exceed Issuer Withdrawal Limit: The customer has exceeded their daily or overall withdrawal limit. Advise them to contact their bank. Offer an alternative payment method.

- Code 63: SEC Violation Credit Card: A security issue occurred, possibly an incorrect CVV. Verify the details. Be cautious if the issue persists, as this could indicate fraud.

- Code 65: Activity Limit Exceeded or Insufficient Funds: Similar to Code 61, the customer has hit a spending limit. They should contact their bank. Offer an alternative payment option.

- Code 97: Invalid CVV: The CVV is incorrect. Verify the CVV. Be cautious, as this could be a sign of attempted fraud.

- Code R0/R1: Stop Recurring Payment: The customer has cancelled a recurring payment. Cancel future payments to avoid chargebacks. If you have a contract with the customer, contact them to discuss the situation.

Credit card declines can be frustrating, but by understanding decline codes and knowing how to respond, you can keep transactions flowing smoothly.

At Bankcard International Group, we provide advanced payment solutions designed to minimize declines through proper routing, advanced data capture and analysis, and merchant account set up to keep your business running efficiently. If you’re experiencing high decline rates or need a better payment processing system, contact us today for a free consultation!